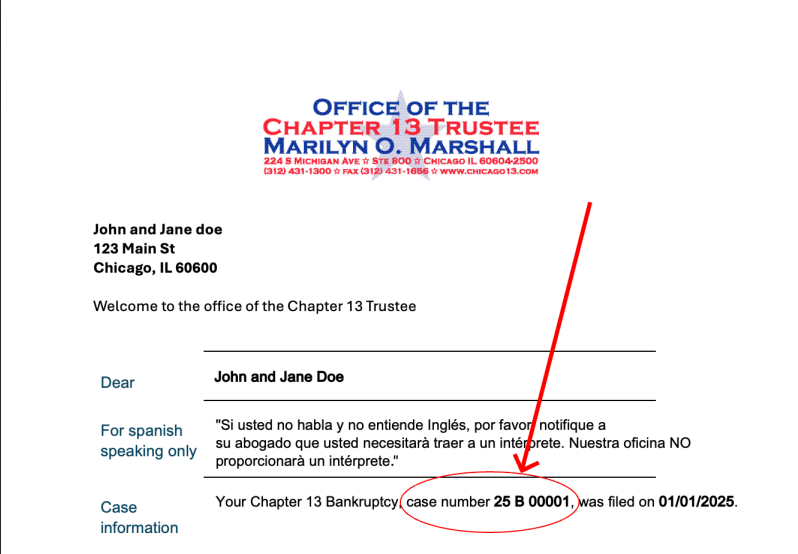

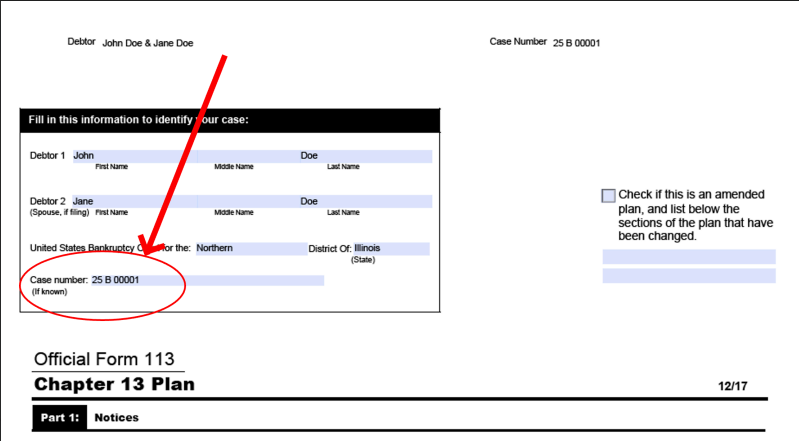

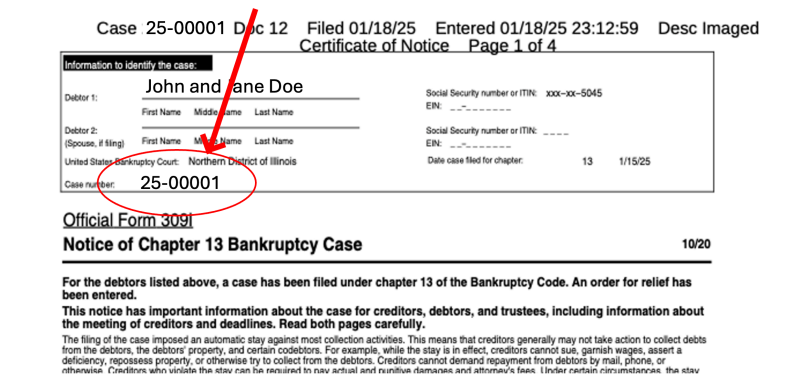

Below are three examples of documents you may have received which may be helpful to you in identifying your bankruptcy case number. The case number is highlighted on each document. Please note that the case number below IS NOT YOUR CASE NUMBER, but is simply an example. When you enter your case number in the Trustee's E-Pay Online System, as part of the E-Pay Online ID process, you should ignore any preceding or trailing letters, as well as the dash and enter the case number as the two digit number followed by the five digit number. Your case number must be exactly seven digits. Again, the documents shown below highlight where a case number might be located on a document you may have received from the Trustee, your Attorney, or the Bankruptcy Court:

Contact Us Email support is available during regular business hours (Monday through Thursday, 9:00 A.M. to 4:00 P.M.) or visit E-Pay Frequently Asked Questions.